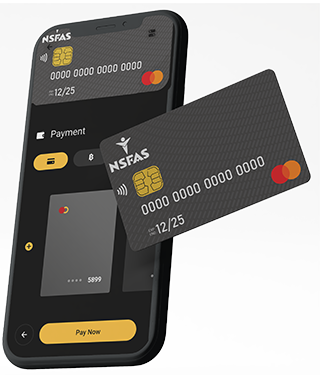

As part of the digital transformation as NSFAS Introduces Bank Account, all NSFAS beneficiaries at universities and TVET colleges will start receiving their allowances and transacting through the NSFAS bank card as of the 2023 academic year.

This new payment solution will alleviate challenges experienced through the current allowance payment method as well as appropriately cater for the ever-increasing number of beneficiaries and large amount of funds to be disbursed.

With the estimated number of NSFAS-funded students at 900,000 not all these students will be onboarded onto the new payment system immediately, NSFAS will pilot this solution with a set number of students first, following which the full roll-out will occur in a phased-in approach.

In the end, all NSFAS-funded students should receive their allowances and transact through the NSFAS Bank Account.

Benefits to the students

How will students benefit from this new direct payment solution?

- Access to value-added services.

- Value for money-negotiated rates.

- Banking freedom.

- Make online transactions and purchases.

- Download the allocated partner’s mobile app and perform EFT transactions.

- ‘Tap to Pay’ functionality and virtual card to pay securely at merchants.

- Receive an sms each time a transaction is carried out via their account.

- The card will be pin enabled which will make it difficult for non-owners to use it fraudulently.

- All these will afford beneficiaries control over their finances and teach them financial responsibility.

RELATED POST: NSFAS 2023 Application Unsuccessful | How to Appeal

To guarantee a pleasant student experience and that student allowances are used for what they are intended for, NSFAS took precautionary measures, and the system will be secure and easy to use.

- Students will be issued a physical and a virtual card.

- The new system will be able to restrict transactions to allowable commodities.

- Students will receive third-party customer rewards as part of the value-added.

- The use of student data will be in line with the Protection of Personal Information Act (POPIA).

- There will be a call Centre facility and several query resolution mechanisms to support students nationally, anywhere in the country.

- The solution will allow students to capture, validate and update their personal details through a secure validation mechanism.

- The solution meets all financial sector regulatory standards and can stop payments, and block/unblock and flag accounts in cases of fraud, death, etc.

- Students will receive essential messages via SMS, email, or other platforms at different points of their transacting journeys.

- Students will have complete visibility of all transactions and balances.

READ ALSO:

Demzyportal Category: NSFAS